Explain the Different Stages of Financing

Reference to the mustard seed. On the far left end of the timeline is the date the idea was created and the.

Startup Funding Explained Investment Rounds And Sources

At this stage commercial selling has not been initiated which is why funding is required.

. Arrangement of Finances - In order to take care of the finances related to the project the sponsor needs to acquire equity or loan from a financial services organisation whose goals are aligned to that of the project. At this stage the funding is required for conducting market research for understanding the product. At times this phase is also termed as the emerging stage first stage funding usually agrees with the corporations market launch when the corporation is about to begin seeing a profit.

In this stage an investor investigates the business plan and the potential of the product or service to succeed in the future which is to be delivered by the entrepreneur. The projects identification depends upon business requirements and industry trends. Period funds locked in years Risk perception.

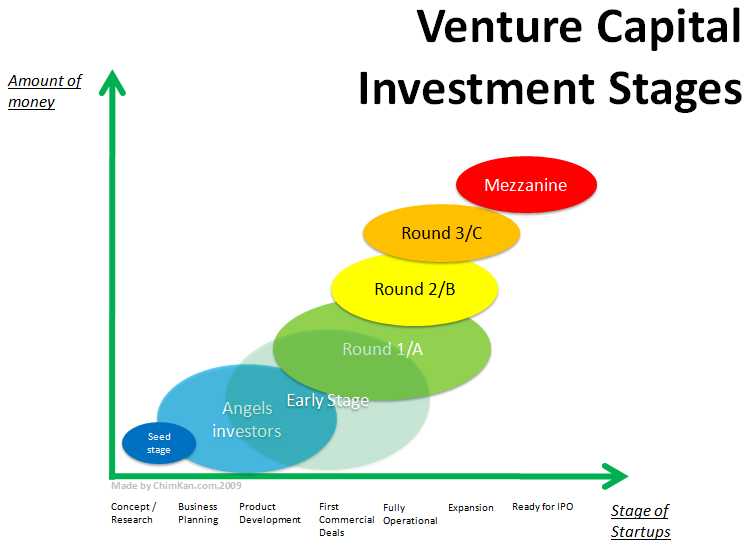

Senior and Subordinated Debt In order to understand senior and subordinated debt we must first review the capital stack. Here are the different stages of venture capital financing. There are typically 3 phases in a business life-cycle notably the start-up phase the growth phase and the maturity phase.

Financing refers to the methods and types of funding a business uses to sustain and grow its operations. Different Stages of Project Financing 1 Pre Finance. It consists of debt.

The First Stage. However the investor now owns a percentage of your. Identification and reach out to possible stakeholders to meet financial.

What happens is largely dependent on a businesss ability to finance itself during the different stages of its life-cycle. Early Stage Investment Series A B 4. Sufficient financing is needed to ensure the smooth transitioning of the business from the pre-launch to the start-up phase.

2 Early Stage. The financial needs of a business will vary according to the type and size of the business. Capitals from this phase of a venture capital funding normally go to actual product manufacturing and sales as well as improved.

This prime stage of seed funding falls so early that its not even considered as a startup funding. Now there are various different sources for getting the required Funding and there are also a lot of stages and steps involved in acquiring this Funding. Equity Financing and Debt Financing.

The five main stages include the following. At this phase the firm ramps up production and. These startup funding stages are.

Later Stage Investment Series C D and so on 5. Financing is necessary to bridge the gap between the time of production and the time of making profit. 9 rows Financing Stage.

3 Formative Stage. Being the most crucial part of Project Financing this step is further sub-categorised into the following. A common misconception surrounding the different stages of venture capital financing is that money only flows to smart people.

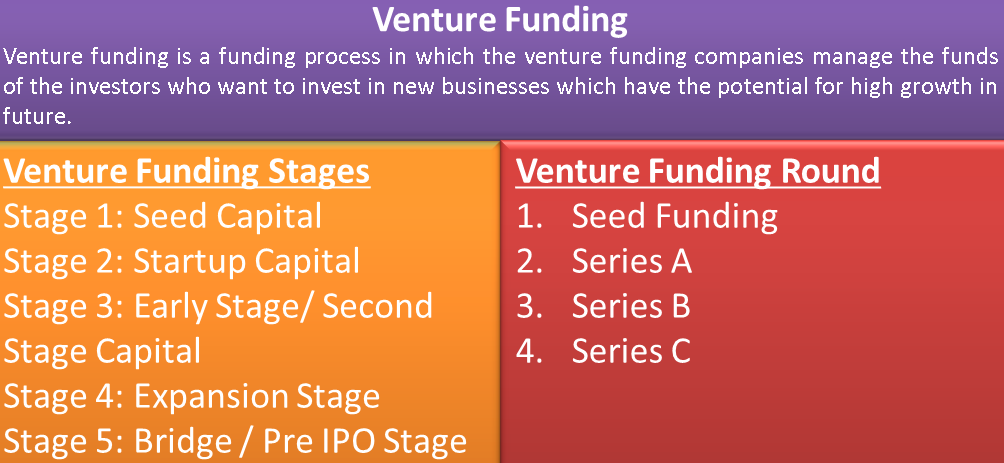

Stages of Venture Capital Financing 1 Seed Stage. These funding rounds or stages includes Pre-seed capital and seed capital Series A B and C funding rounds. Capital stack ranks the priority of different sources of financing.

This is the first step in the funding process and is also commonly known as the bootstrapping stage. Some common source of financing business is Personal investment business angels assistant of government commercial bank loans financial bootstrapping buyouts. Now lets delve deeper into different stages of fundraising in a startup lifecycle.

In finance this is an allusion to economic events that will bloom into a bull market recovery. In equity financing either a firm or an individual makes an investment in your business meaning you dont have to pay the money back. First-stage capital is needed to expand production to satisfy market demand.

The Pre-seed capital and seed capital stages of financing in business represent funding in the. Retail businesses usually require less capital. Businesses especially startups raise capital for various levels and types of business operations through series or multiple rounds of financing and funding.

Though sometimes called first stage this stage only comes after the seed and startup ones in most cases. To begin to understand the terms describing the different fundraising stages think of the new venture on a timeline. Let us discuss the sources of financing business in greater detail.

VC funding may be diverted to acquiring more management personnel fine-tuning the productservice or conducting additional research. Sources of Financing for small business or startup can be divided into two parts. Early stagefirst stagesecond stage capital.

As the term suggests the start-up will grow by making use of the capital invested by angel investors or venture capitalists. Government grants to finance certain aspects of. Activity to be financed.

The Pre-seed Funding Stage. Most companies that raise equity capital and are eventually acquired or go public receive multiple rounds of financing first. Debt and equity are the two major sources of financing.

The dynamics between the two parties explain why founders choose to offer equity partial ownership of their company in exchange for money - if the business grows so will the value of the shares that investors own. For example processing businesses are usually capital intensive requiring large amounts of capital. The pre-seed funding stage generally refers to the time period in which a startup is getting their operations off the ground.

Stages Of Venture Capital Financing Mba Knowledge Base

Venture Capital Presentation Entrepreneurship Bba Mantra

Comments

Post a Comment